If you have an SMSF paying a pension, you are required to take a minimum amount of income each year from your account.

In response to COVID-19, the government temporarily lowered the annual minimum amount until 30 June 2023. From 1 July 2023, the reduction to the minimum pension drawdown requirements no longer applies. Therefore, minimum drawdown rates are now reinstated to their pre-pandemic level.

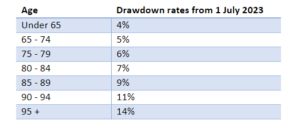

Refer to the table below for more information.

Minimum percentage of account balance factors, by age

It is crucial to ensure that your SMSF complies with these revised drawdown rates for the 2024 financial year. SMSF trustees should review their pension payment schedules to align with the updated requirements. Failing to meet the minimum pension requirements for a financial year has a substantial impact for SMSFs who are claiming a tax exemption on income from assets that support a pension.

Plan Ahead

Given the significance of these changes and the requirement for additional liquidity, it is important to plan ahead and make any necessary adjustments to your financial plans to accommodate the updated drawdown rates.

Questions?

If you have any questions about your SMSF compliance or need to review your pension strategies, please contact your regular Blaze Acumen advisor or any of the following:

Michelle McKenzie

Partner 03 9694 3040 mmckenzie@blazeacumen.com.au

Erica Harper

Partner 03 9694 3045 eharper@blazeacumen.com.au

Adam Konsak

Director 03 9694 3085 akonsak@blazeacumen.com.au

Disclaimer: The information contained in this bulletin contains factual information and makes no recommendation or gives any opinions. Accordingly, it is not financial product advice and should not be relied upon as financial product advice.