We note that the previous version sent contained incorrect information. This has now been updated and we apologise for the inconvience.

__________________________________________________________________________________________________________________________________________

The year ending 30 June 2020 marks the first year that it is possible for those who meet certain conditions to make concessional contributions in excess of the regular cap of $25,000 per annum.

This relatively new measure, effective from 1 July 2018, allows those who are eligible who do not use their full concessional contributions cap to “carry forward” the unused part of their cap for up to five years.

If eligible, this measure can be used to make additional concessional contributions in a subsequent year without creating an excess. This provides more flexibility for people who have lower superannuation balances to make contributions when they are able to.

WHO IS ELIGIBLE?

To make “catch up” concessional contributions, you must:

- Have a total superannuation balance (TSB) of less than $500,000 at 30 June in the year before the catch up contributions are to be made, and

- Be eligible to make concessional contributions (or have them made on your behalf).

Once eligible:

- You must first use the relevant concessional contributions cap for the year in which the carried forward amounts are used, then

- You can carry forward the unused concessional contribution cap amounts for no more than 5 years. If they are not used by the end of five years, they lapse.

HOW DOES IT WORK?

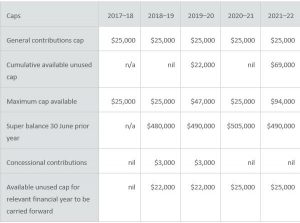

The practical implementation of these new rules is best explained using an example. The following example is from the ATO, and illustrates the operation of the carry forward concessional contribution rules.

During 2018–19 to 2021–22, Sam has minimal super contributions as he is working part-time while completing studies. His super balance is continuing to grow with earnings and a small amount of super contributions but in 2020–21 his account balance reduced due to negative returns in that year. Sam has unused cap amounts for each of the 2018–19 to 2021–22 financial years.

Sam would be entitled to use the unused concessional cap amounts in 2019–20 and 2021–22 as his total super balance at the end of 30 June in the year immediately preceding was less than $500,000.

Sam would not be able to use his unused concessional cap contributions in 2020–21 as his total super balance at the end of 30 June of the previous year was $505,000.

In 2021–22 Sam returns to work. For that year he has a maximum concessional cap amount available of $94,000 ($69,000 plus $25,000) for 2021–22 and is eligible to contribute this amount as this total super balance at the end of 30 June 2021 was now less than $500,000.

WHO MIGHT BENEFIT?

The ability to make catch up concessional contributions may suit those who:

- have not fully utilised their concessional contribution caps in the 2018–19 financial year or a later financial year, such as lower income earners or those who do not work for the full financial year;

- have less than $500,000 at the end of the financial year immediately preceding the year in which the unused unapplied concessional contribution caps will be applied; and

- may wish to contribute additional amounts to superannuation when they have the ability to do so.

Questions?

If you have any questions, please contact your Blaze Acumen adviser.