Vacant Residential Land Tax (“VRLT”) was introduced in Victoria back in 2017 and was effective from 1 January 2018. However, this state tax was not widely known because its operation had been largely limited to foreign property owners in urban Melbourne council areas. However, clients with property interests in Victoria outside of metropolitan Melbourne will now need to consider the impact of VRLT going forward.

The State Taxation Acts and Other Acts Amendment Act 2023 (Vic) (“the Act”) received assent on 12 December 2023.

The Act introduced changes to VRLT which has expanded its reach and has the potential to affect property owners in Victoria more widely where properties are considered “vacant”. Concessions have been made for holiday homes in personal names and whilst the Government has made a verbal commitment to extend that concession to include holiday homes held in trusts and companies as at 28 November 2023, this was not included in this round of amendments.

The Act amends the Land Tax Act 2005 (Vic) with respect to VRLT to include:

- From 1 January 2025, applying VRLT to residential land across all of Victoria if the land is “vacant” for more than 6 months in the preceding calendar year;

- From 1 January 2025, applying a new progressive rate of VRLT to non-exempt residential land across all of Victoria based on the number of consecutive tax years the land has been liable for VRLT;

- From 1 January 2026, applying VRLT to all unimproved residential land in metropolitan Melbourne that has remained undeveloped for at least 5 years and is capable of residential development, subject to certain exemptions;

- From 1 January 2025, amending the VRLT holiday home exemption to enable the usage and occupancy requirement to be satisfied by a relative of the owner or vested beneficiary, and

- From 1 January 2025, allowing the VRLT exemption for new residential premises to be extended to a maximum exemption for 3 years in specified circumstances.

The 2025 calendar year will see a significant expansion in VRLT’s reach as it is no longer confined to specific Metropolitan Melbourne areas and will instead apply to residential land statewide.

From 1 January 2025, a new progressive rate of VRLT will apply to non-exempt vacant residential land across all of Victoria based on the number of consecutive tax years the land has been liable for VRLT:

- 1% of the capital improved value of the land for the first year the land is liable for VRLT where the land was not liable for VRLT in the preceding tax year;

- 2% of the capital improved value of the land where the land is liable for VRLT for a second consecutive year; and

- 3% of the capital improved value of the land where the land is liable for VRLT for a third consecutive year.

The application of VRLT in a calendar year looks at the usage of the property in the preceding calendar year. It is necessary to understand how the taxing mechanism works to ensure that the property is not considered “vacant” during a 12-month period.

The following scenarios set out the circumstances where properties will not be subject to VRLT:

1. The property is outside of the definition of residential property. This is the case for

unimproved land (vacant land). This also applies to land that is capable of being used and

occupied solely or primarily as:

a. Commercial residential premises;

b. A residential care facility;

c. A supported residential service; and

d. A retirement village.

It is important to note that unimproved land is generally not considered as residential property for VRLT purposes. However, from 1 January 2026, the VRLT reach will be extended to include all unimproved residential land in metropolitan Melbourne that has remained undeveloped for at least 5 years and is capable of residential development with some exemptions.

2. The residential property must not be vacant.

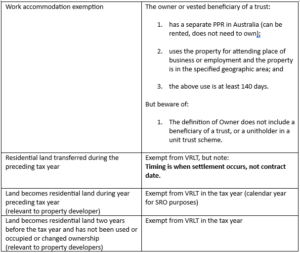

3. One of the following exemptions from VRLT applies:

If the residential property is considered “vacant”, the owner must notify the SRO by 15 January each year via SRO’s online portal. The notification is required even when a specific exemption can apply (but not when the land is already exempt from land tax). When completing the notification, the land owner will need to notify and advise which exemption applies. Failure to notify may result in penalties.

As the law currently stands, the holiday home exemption does not extend to holiday homes held by trusts or companies. However, the Hon. Danny Pearson stated in his speech delivering State Taxation Acts and Other Acts Amendment Bill 2023 to Victorian Parliament made the following commitment on behalf of the Government:

“The government has also committed to extending the holiday homes exemption to include properties held in a trust or company as of 28 November 2023, when this change was made public.”

The speech can be accessed via the following link: https://www.parliament.vic.gov.au/parliamentary-activity/hansard/hansard-details/HANSARD-2145855009-23424

The above comments have not yet been incorporated into the Act.

Examples and common scenarios:

Holiday homes in personal names

If the home is not considered vacant for VRLT purposes (i.e. satisfies the 4 week usage requirement), then the holiday home exemption should be available. That is, the owner or relative needs to have more than 4 weeks of use. However, care needs to be taken that the owner can only have one home exempt under this exemption.

Multiple holiday homes

The first consideration is whether the use pattern leads to the conclusion that the property is not vacant. If vacant, then it is necessary to examine if the holiday home exemption can apply. Note that if multiple homes are in joint names, it could be problematic that only one home is exempt. This is an important consideration for those looking to acquire an additional property, particularly if asset protection concerns are relevant in making decisions regarding who should be the owner. Where the holiday home exemption from VRLT is not available to a second holiday house, the owners will need to consider the requirements for the property to be exempt through letting and genuine lease arrangements.

A property owned by parent(s) that is provided to an adult child to live in rent free

It is not considered vacant if an adult child occupies the property as their principal place of residence. However, if the property is not the adult child’s principal place of residence then VRLT will apply unless the parties enter into a genuine lease in good faith. Whilst this may serve to avoid liability to VRLT, it will have other implications such as deriving rental income which the property owner will be assessed on for income tax purposes.

Conclusion

Whilst a liability to VRLT for properties outside of metropolitan Melbourne will not generally arise until 1 January 2025, it is based on the use of the property for the previous calendar year. This means that how you use the property between now and 31 December 2024 will determine whether you are liable for VRLT.

Each client situation is likely to be different, so it is important that you contact your Blaze Acumen adviser to discuss your circumstances and consider what steps may be necessary.