This update is intended to assist you in navigating the rules regarding several key changes and to provide topical information with respect to superannuation.

Disclaimer: The information contained in this bulletin contains factual information and makes no recommendation or gives any opinions. Accordingly, it is not financial product advice and should not be relied upon as financial product advice.

Indexation of the General Transfer Balance Cap

Effective from 1 July 2023, the General Transfer Balance Cap for has been increased from $1.7 million to $1.9 million. This cap represents the maximum amount an individual can transfer into a tax-free retirement phase pension. Members who have not yet commenced a retirement phase pension will receive the full benefit of this increase, while members with existing pensions will have a proportionate increase in their cap based on their highest transfer balance amount. Members who have previously utilised their full $1.6 million cap will not receive any change to their respective cap.

Change in Total Superannuation Balance Caps for Non-Concessional Contributions (NCC)

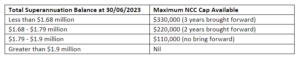

The increase in the General Transfer Balance Cap brings with it changes to non-concessional contributions and bring forward eligibility. The following table illustrates the maximum NCC cap available based on a member’s Total Superannuation Balance at 30 June 2023:

Removal of Work Test for Contributions

From 1 July 2023, individuals aged between 67 and 75 years no longer need to satisfy the work test to make salary sacrifice and non-concessional contributions. Members can also access the bring-forward rule for non-concessional contributions subject to their Total Superannuation Balance.

It is important to note that the work test still applies for members between 67 and 75 wishing to claim a deduction for personal superannuation contributions, and such members will need to complete 40 hours of gainful employment in a 30-day period in order to do so.

Reduction in Age for Downsizer Contributions

As of 1 January 2023, the age requirement for members wishing to make downsizer contributions has been lowered from 60 to 55 years. Subject to meeting other eligibility criteria, an individual selling a home they have owned for more than 10 years may be able to make a contribution of up to $300,000 from the proceeds of the sale that will not count towards their non-concessional contribution cap and is not subject to total superannuation balance restrictions.

Transfer Balance Account Reporting (TBAR) Changes

All SMSFs will now be required to lodge TBARs within 28 days after the end of each quarter, starting from 1 July 2023.

Any Transfer Balance Events, such as pension commencements or commutations should be communicated to us as soon as possible so that we can attend to timely lodgement of TBARs.

Removal of 50% Reduction in Minimum Pension Payment

In response to COVID-19, the government temporarily reduced superannuation minimum drawdown requirements for account-based pensions and similar products by 50% for the 2019–20, 2020–21, 2021–22 and 2022–23 financial years.

For the 2023–24 financial year, the 50% reduction in the minimum pension drawdown rate will no longer apply. This will result in a significant increase in pension drawdown requirements. SMSF trustees should be prepared for this change and ensure their fund has sufficient liquidity to meet the higher level of required payments. Please refer to our earlier Client Alert No.97 – Substantial increase to SMSF pensions for the 2024 year on this issue.

Importance of Updated Valuations for Properties and Unlisted Investments

Earlier client alerts have raised the importance of obtaining sufficient evidence to support market values for properties and unlisted investments. See Client Alert No.89: Valuation of property and unlisted investments and more recently Client Alert No.98 – The importance of valuing your assets.

SMSF trustees who have invested in property or other unlisted assets must ensure that they are valued at market value at year end based on objective and supportable data.

Division 296 Tax: the proposed $3m superannuation tax

The Federal Government has formalised its intention to reduce concessions for individuals with superannuation balances exceeding $3 million through a proposed ‘Division 296 Tax’. If passed into law, this legislation will impose an additional 15% tax on the earnings derived from superannuation balances surpassing the $3 million threshold.

Although these proposed changes have been widely discussed, their practical implications remained unclear until recently when the Treasury unveiled an Exposure Draft of the legislation, now officially known as Division 296 Tax. Consequently, some taxpayers might find themselves liable for tax on profits or gains they never actually realise, introducing a potential area of dispute and concern within the proposed tax framework. If legislation receives Royal Assent, it will take effect from 1 July 2025.

We will continue to monitor developments with respect to this proposed additional 15% tax and will provide further updates as details become known. Given the legislation remains in draft form there will be adequate time to review your superannuation strategy before it takes effect.

Questions?

It is important that SMSF trustees stay up to date with superannuation changes and seek appropriate advice where necessary. If you have any questions about your SMSF compliance or any of the above areas, please contact your regular Blaze Acumen advisor or any of the following:

Michelle McKenzie

Partner 03 9694 3040 mmckenzie@blazeacumen.com.au

Erica Harper

Partner 03 9694 3045 eharper@blazeacumen.com.au

Adam Konsak

Director 03 9694 3085 akonsak@blazeacumen.com.au