Author: Daniel Bolzonello, Partner

5/12/2025

Background

The ATO has recently released the following draft taxation ruling and practical compliance guideline that may affect those who own holiday homes or rental properties that are also used privately:

- TR 2025/D1 Income tax: rental property income and deductions for individuals who are not in business, which outlines the ATO’s approach to rental income, deduction apportionment and the impact of private use; and

- PCG 2025/D7 Application of section 26-50 to holiday homes that you also rent out, which provides the ATO’s compliance and risk-assessment framework for holiday-home owners.

Together, these documents underscore that deductions will only be available where a property is genuinely used to generate rental income, not simply held out for rent or used privately for part of the year.

Peak-Season Private Use / Off-Peak Rental focus

The ATO is paying close attention to properties that are used privately during peak periods (e.g., school holidays, public holidays, December holidays) and rented only during off-peak times. This is considered a higher-risk scenario.

If the property is mainly for private enjoyment, many holding costs may no longer be deductible. Expenses such as mortgage interest, council rates, insurance, maintenance and capital works may be denied. Only costs directly related to off-peak rentals (for example, cleaning or agent fees) may remain deductible.

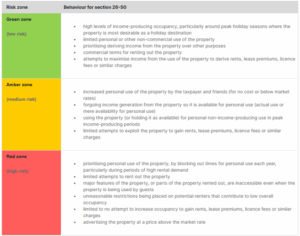

In the Practical Compliance Guideline, the ATO uses 3 coloured zones to denote risk ratings in relation to how section 26-50 may apply to your arrangements, as follows:

Why This Sudden Focus by the ATO?

The ATO’s concern stems from observations that many holiday type properties are not genuinely operated with a commercial rental objective. In particular, where a property is made available for only part of the year (e.g. outside peak holiday seasons) or is used by the owner (or their friends/family) for personal enjoyment, the ATO considers that the “mainly income-producing” threshold may not be met.

By clarifying its compliance approach through PCG 2025/D7, the ATO is signaling that it will scrutinise rental holiday home arrangements more closely and may disallow deductions where the facts suggest the property is used primarily for leisure rather than as a genuine rental investment. For example, if the family were to use a holiday home privately over the December – January period and this coincides with the highest income earning potential of the property, then that use will have diminished the ability to generate a commercial return from rental income for the year.

In short: the ATO’s concern is not just whether a property is rented, but whether the pattern and purpose of use reflect a genuine income producing rental business (rather than a private holiday/leisure home). The new guidelines are intended to give transparency about when deductions may be denied, and to direct compliance resources toward arrangements that appear to be more “holiday home” than “rental property.”

Implications for Taxpayers

Key implications arising from the draft ruling and PCG include:

- Rental deductions (including holding costs) are only available to the extent the property is genuinely available and used for rental at market rates, with broad advertising and realistic terms.

- Any period where the property is reserved for private use (even if the owner does not stay there) must be excluded from deductible expenses.

- Rentals to relatives/friends at below-market rates are unlikely to attract deductions beyond the actual income received.

- The ATO expects objective documentation: advertising records, booking history, enquiry and correspondence logs, market-rate pricing evidence and occupancy records.

- If a property is used privately during its peak income-earning period, the ATO’s view is that deductions will not simply be spread evenly over the year. Instead, they may be significantly reduced to reflect the fact that the property was unavailable during the key period in which it would ordinarily have generated the bulk of its rental income.

The following example is an extract from the above PCG 2025/D7

Example 5 – prioritising personal use of seasonal property

Ling owns a luxury ski chalet in Thredbo, New South Wales. The property is advertised online via sharing economy platforms.

During the ski season, which lasts around 4 months, Ling uses the property for a few days per fortnight, blocking it out for her personal use so she can enjoy skiing. When the property is not used by Ling during the ski season, it is consistently booked. In the off-season, the chalet attracts occasional weekend bookings.

Ling’s chalet is a holiday home because she uses it for holidays or recreation. Ling’s approach to the chalet indicates an intention to produce some income from it. However, she extensively uses the chalet privately during the ski season which is a peak income-earning period.

If Ling wants to shift to the green zone, she could reconsider her personal usage of the property during peak ski season when the property has the highest income-earning potential.

What Owners Should Do

To manage risk and maintain access to deductions, property owners should:

- Advertise broadly and transparently on commercial terms comparable to similar properties;

- Maintain thorough records of advertising, bookings, enquiries, pricing decisions and actual use;

- Avoid blocking out peak seasons for private use where possible; and

- Ensure related-party rentals are at commercial market rates, properly documented and supported by market evidence.

Next Steps

Although both TR 2025/D1 and PCG 2025/D7 remain in draft, they clearly signal the ATO’s direction and compliance intent. If you own a holiday home or rental property and wish to understand how these changes may affect your tax position, please reach out to us.